©2021 Reporters Post24. All Rights Reserved.

Starlink’s satellite-based broadband service is unlikely to gain mainstream adoption in India in the medium term due to its prohibitively high pricing, particularly for rural markets, analysts said, adding that the high pricing will likely position it as a premium service, complementary to FWA and Fiber services largely for small business users.

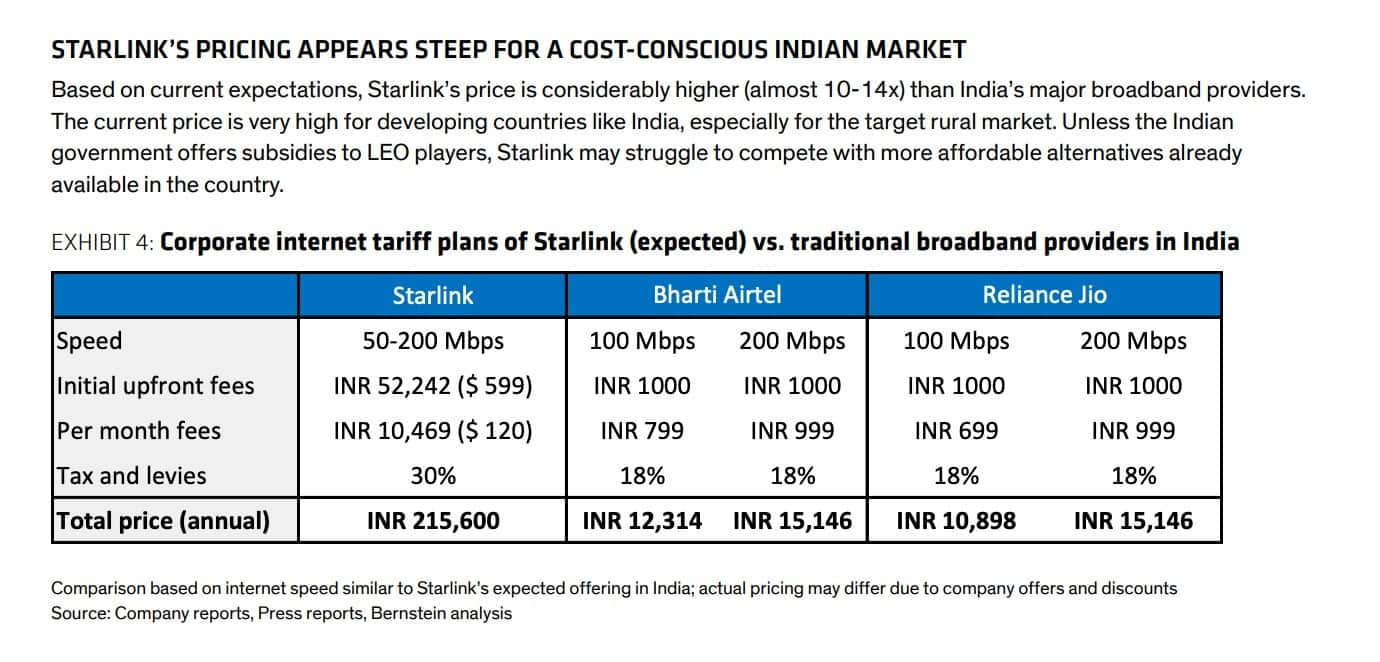

They added that the service is priced 10-14 times higher than offerings from major broadband providers Reliance Jio and Bharti Airtel, making it difficult for low-earth orbit (LEO) satellite providers to compete without government subsidies.

Bernstein noted that Starlink’s pricing carries a 9-175% premium over local broadband operators in key Asian markets, excluding the already high upfront equipment costs. This poses scalability challenges, particularly in India, which has the lowest data costs globally.

“Current Starlink pricing plans are considerably higher across APAC. We expect Starlink offerings to be positioned as premium services,” Bernstein stated.